Morpara

Designing a regulation-resilient fintech platform for international money transfers in a hyperinflation economy

Over 300,000 downloads

on IOS & Android devices

3.9/5 App Store Rating

among users

Introduction: Translating a fintech vision into a scalable and compliant product experience

Morpara entered the market with a clear business vision and defined performance metrics. After exploring multiple design partners, the company selected Agency Look following rounds of briefings and strategic presentations where we demonstrated how we would translate their vision into a tangible, scalable product.

At the time the project was greenlit, I was already working on multiple end-to-end projects. Despite a full schedule, I volunteered to take ownership of Morpara because of its complexity. Designing for a heavily regulated financial environment while aligning with strict performance metrics presented a challenge that demanded strategic thinking beyond interface design.

My role: Sole product designer owning strategy, UX architecture, and system design

I was assigned as the primary product designer responsible for the full product lifecycle, including:

Product research and competitive analysis

UX and product strategy definition

Information architecture and flow design

Low-fidelity concept exploration

Design system creation and maintenance

High-fidelity prototyping and iteration cycles

Moderating stakeholder demos and critique sessions

Developer documentation and structured handoff

Throughout the project, I translated business requirements and regulatory constraints into structured user flows and scalable product logic. In several key areas, I proposed alternative solutions that challenged the predefined strategy. After presenting structured arguments and prototypes to stakeholders, multiple proposals were adopted into the final product, elevating the experience beyond the original vision.

Problem framing: Designing for international transfers under constant regulatory volatility

Turkey’s economic instability and hyperinflation introduced major disruptions to international financial transactions. Government regulations around foreign currency accounts, transfer limits, and authorized fintech services were frequently updated. Several global platforms were restricted or banned, leaving individuals and businesses without reliable international transfer options.

The environment presented multiple challenges:

Rapidly changing compliance requirements

Restrictions on non-bank fintech institutions

Foreign currency holding limits

Increased documentation requirements

User confusion around policy changes

Morpara aimed to create a frictionless alternative in a system increasingly designed to introduce friction. The product needed to remain flexible, compliant, and transparent while shielding users from regulatory complexity.

Competitive analysis: Reverse-engineering fintech leaders without a research budget

The client did not allocate budget for user interviews or usability testing. To compensate, I conducted an extensive competitive analysis of local and global fintech platforms operating in similar domains.

Products analyzed included:

Wise

PayPal

Tinkoff

Papara

FUPS

The analysis focused on:

Information hierarchy and navigation models

Transaction transparency patterns

Risk communication strategies

Feature prioritization

Conversion optimization within onboarding flows

From these insights, I generated structured user stories to guide product decisions.

Example User Stories:

As a resident in Turkey facing unstable international transfer access, I want a reliable and regulation-compliant platform so I can send and receive money abroad without sudden service disruptions.

As a traveler, I want to use one app and one card across currencies so I don’t need separate bank accounts in each country.

As a parent with a child studying abroad, I want clear, step-by-step instructions to send money confidently without assistance.

As an independent business owner, I want secure international transfers so my funds remain protected during unexpected disruptions.

As a business owner, I want flexible foreign payment options to expand my international customer base.

Regulatory deep dive: Aligning product strategy with legal and governmental constraints

Beyond competitive analysis, I conducted independent research into financial regulations affecting foreign currency accounts and international transfers. To ensure compliance and reduce future risk, I scheduled meetings with Morpara’s legal and project management teams to clarify:

Current regulatory boundaries

Areas likely to change

Legal limitations for fintech institutions

Risk exposure scenarios

Contingency planning strategies

This collaboration allowed me to design flows that were not only compliant at launch but adaptable to future regulatory shifts.

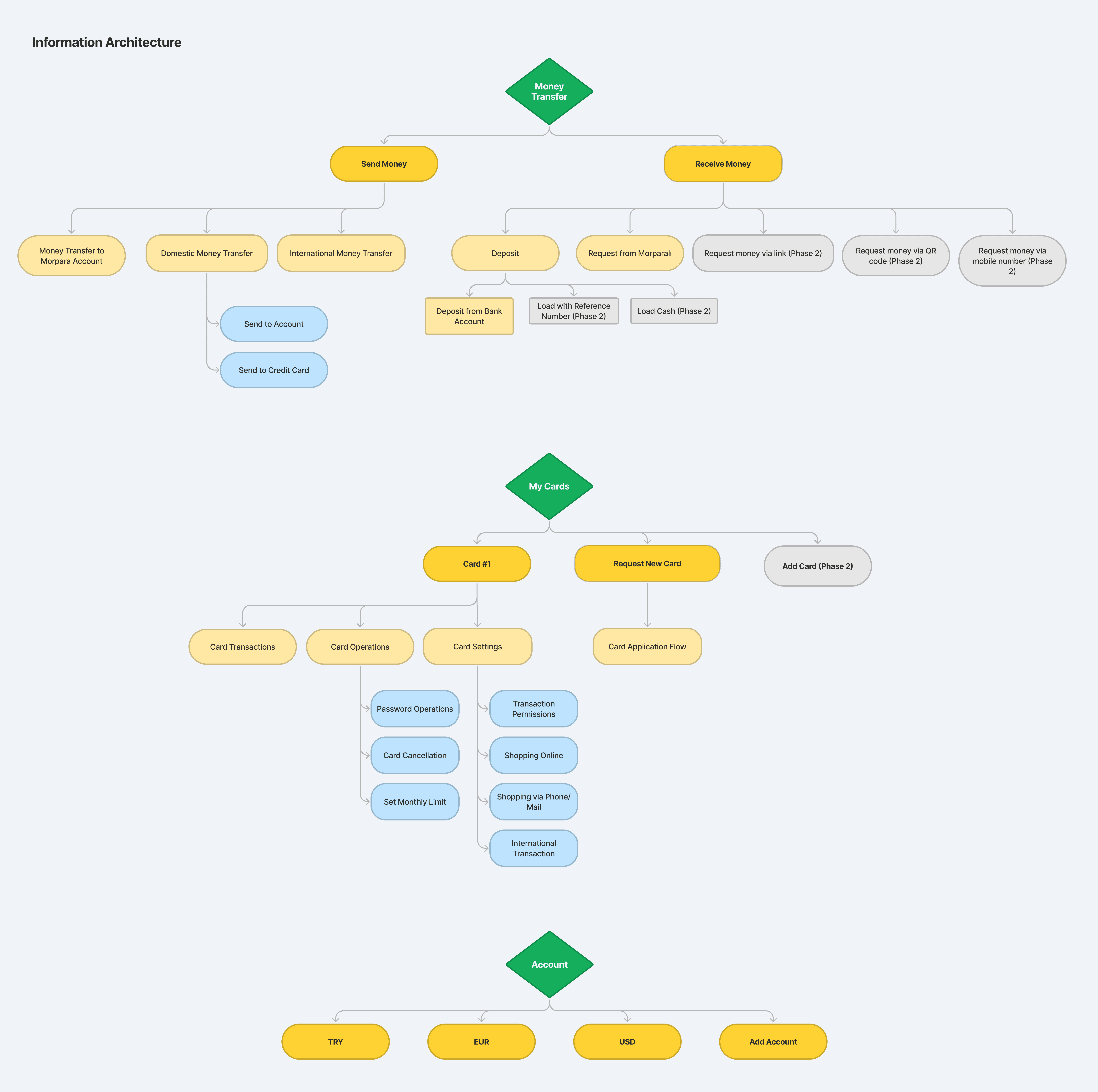

Information architecture: Building transparency, error prevention, and adaptability into the core

Based on research and constraints, I defined core strategic principles that shaped the product architecture:

Radical transparency in all transaction states

Dedicated space for regulatory updates, guides, and announcements

Clear, jargon-free microcopy for users with varying financial literacy

Immediate access to all money transfer actions

Fragmentation of complex processes into smaller, manageable steps

Flexible automation logic to support regulatory adaptation

Friction layers in high-risk areas for error prevention

Support for multiple transaction modes, including card usage and online payments

Once these principles were defined, I constructed the full flow architecture and information hierarchy before moving into conceptual design.

Concept exploration: Validating structure before visual commitment

With flows established, I created low-fidelity wireframes to visualize page structure, functionality, and interaction patterns. These wireframes were presented to Morpara stakeholders for validation and critique.

After incorporating structured feedback, I refined and finalized the interaction model before transitioning to high-fidelity designs.

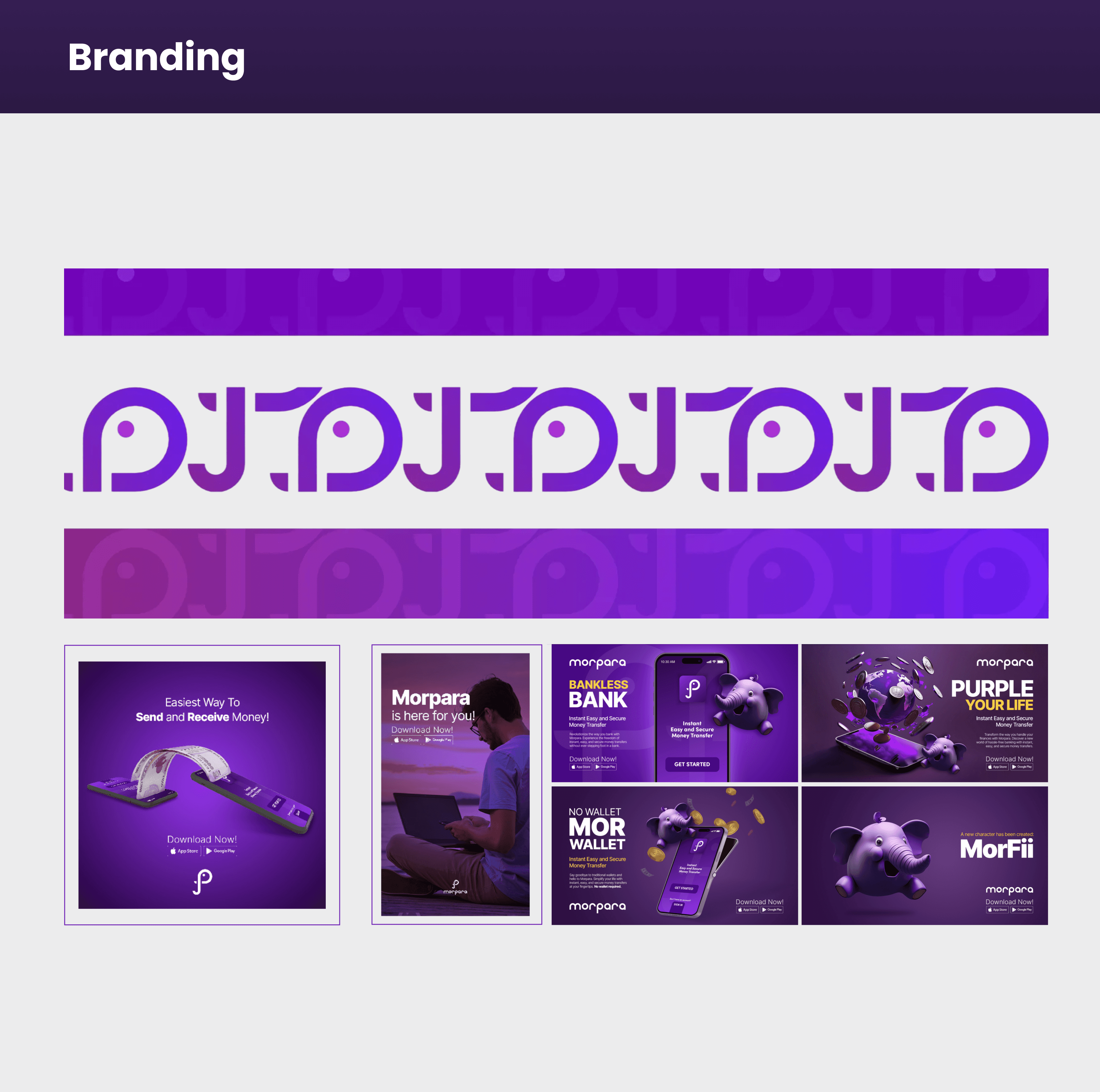

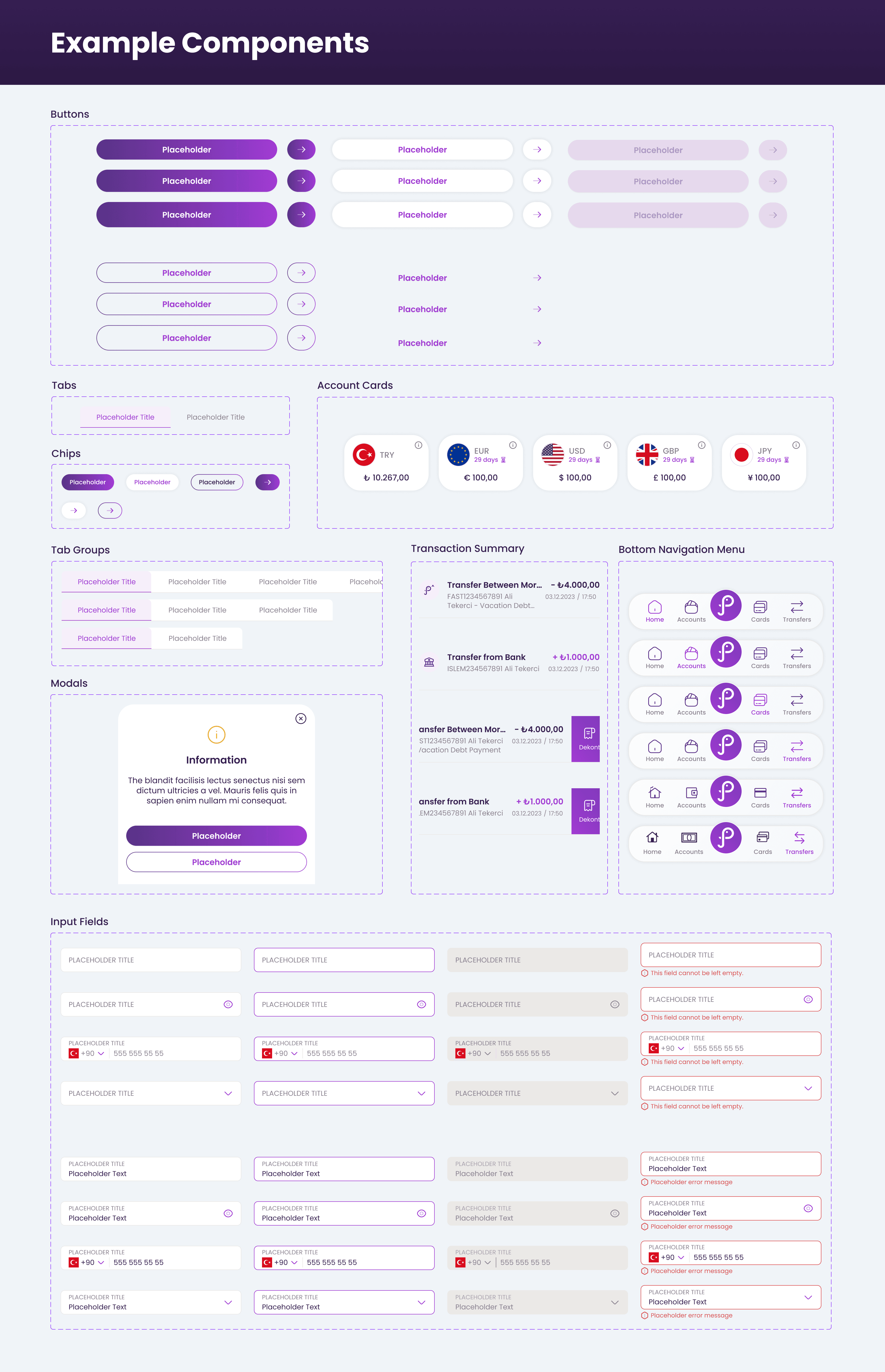

Design system: Building a scalable foundation for Morpara’s expanding ecosystem

Morpara required a custom-built design system that could support long-term scaling and future product releases.

Key considerations included:

Alignment with existing brand identity

Component-based architecture using advanced property structures

Consistency across iOS and Android despite unavailable official UI kits at the time

Documentation enabling developer independence after agency handoff

I collaborated closely with external developers to clarify native component behavior and ensure implementation accuracy. The final system served not only the launch product but also future releases and ecosystem expansion.

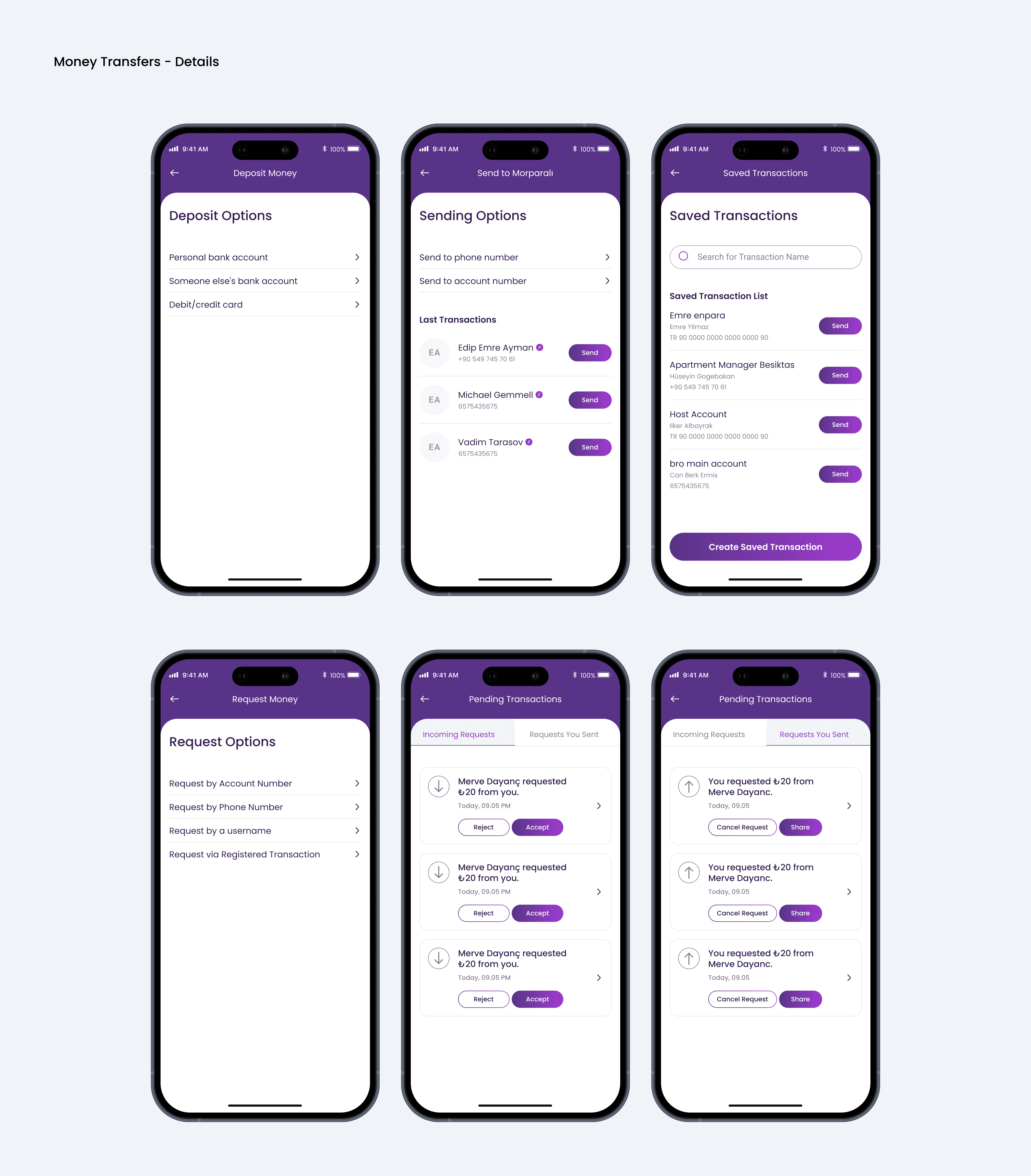

Personal contribution: Creating a global money transfer super menu

Money transfers were the product’s most critical feature. The initial proposal placed transfer options on the homepage above the fold. However, this conflicted with three essential homepage elements:

Account balance overview

Informational stories and updates

Transaction history list

Adding another section risked diminishing visibility of core financial information.

I proposed detaching money transfers from the homepage and introducing a dedicated bottom navigation entry that opened a global overlay containing all transfer options.

This solution:

Enabled single-tap access from any primary screen

Reduced scroll-based friction

Simplified future feature expansion

Decreased long-term architectural complexity

Although it introduced additional development effort during the alpha stage, the measurable usability and scalability benefits convinced stakeholders to adopt the change.

Personal contribution: Automating regulatory compliance for foreign currency accounts

Frequent regulation changes required users to convert foreign currencies within specific timeframes. Expecting users to track these policies manually created financial risk and user frustration.

I designed a time-based automation system that:

Automatically converted foreign currency holdings after the legally defined period

Sent scheduled in-app and email notifications

Increased notification frequency as deadlines approached

Allowed manual intervention before automated conversion

This approach balanced compliance, transparency, and user protection while minimizing future redevelopment costs caused by regulatory updates.

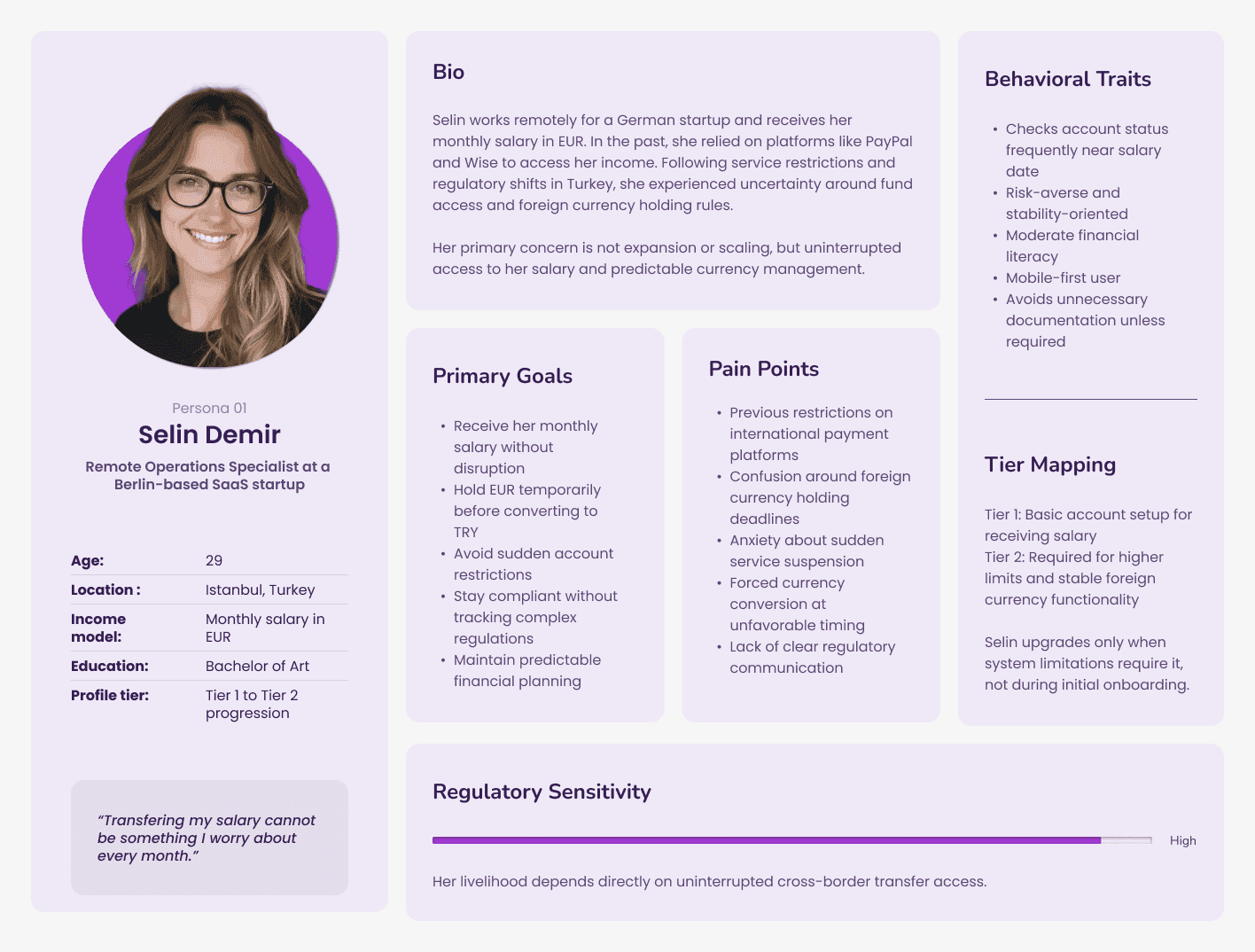

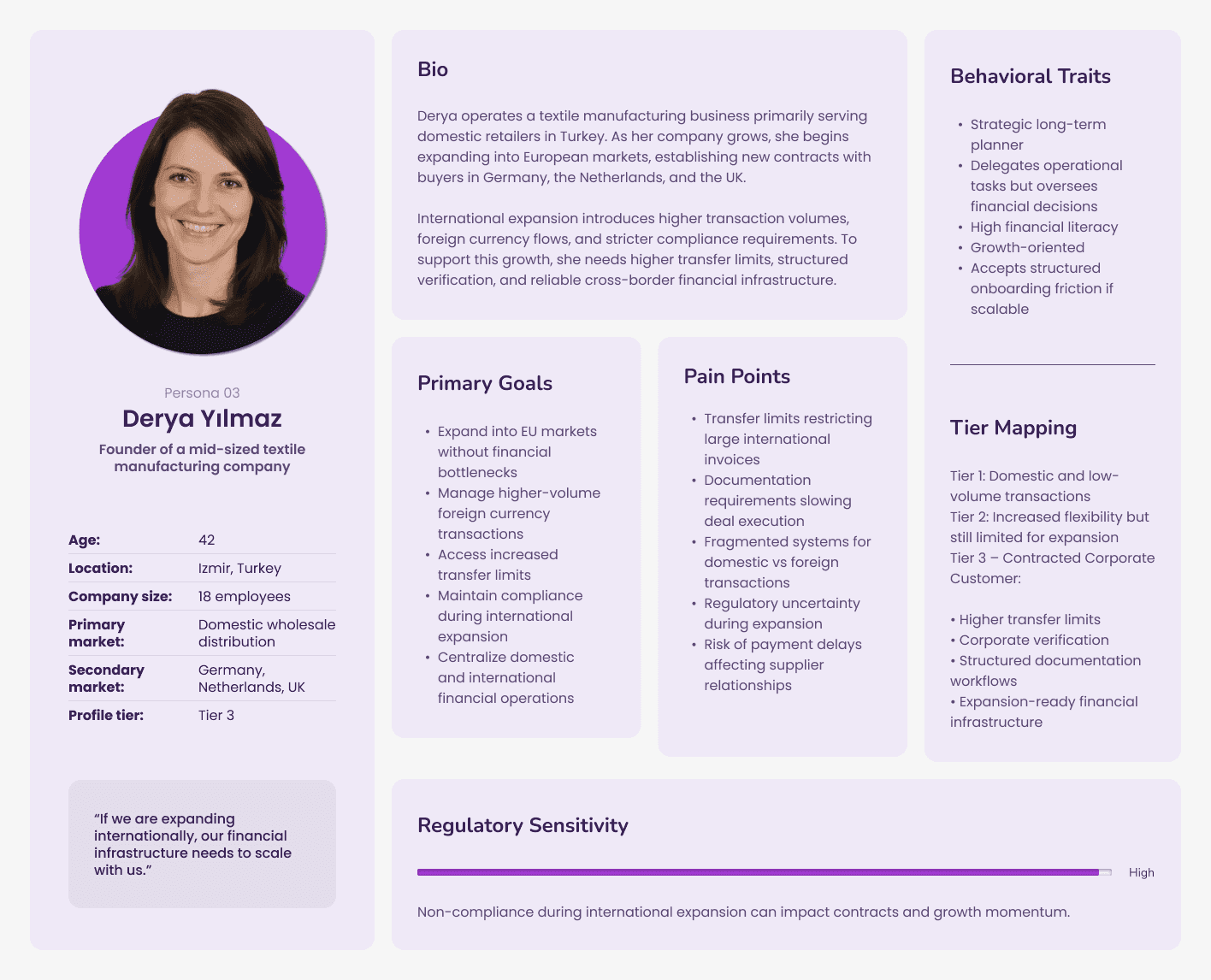

Personal contribution: Introducing tiered verification to reduce onboarding friction

Regulations required different documentation levels depending on transaction type. A single onboarding path would have introduced unnecessary friction for users performing only basic transactions.

I introduced a three-tier profile system:

Unverified customers

Verified customers

Contracted corporate customers

Users began at the lowest tier and upgraded only when required.

This structure:

Reduced initial onboarding time from days to approximately 10 minutes

Increased conversion rates by minimizing early friction

Structured complex compliance processes into progressive stages

Tech stack: Supporting strategy, collaboration, and production

To execute the project efficiently, the following tools were used:

Slack for internal communication

Jira for sprint and task management

Microsoft Teams for stakeholder presentations

Miro for flow diagrams, sitemaps, and ideation

Figma for wireframing, prototyping, and system design

Photoshop and Illustrator for asset creation

Results: Scaling adoption while reducing compliance friction

Since launch, Morpara has achieved:

300,000+ downloads

A 3.9/5 App Store rating in a highly regulated domain

Additional long-term impact included:

Automation logic reducing repeated development cycles caused by regulatory shifts

A scalable design system accelerating new feature releases

Reduced onboarding friction and improved conversion

Morpara demonstrates how thoughtful product architecture, regulatory awareness, and strategic UX decisions can transform complexity into a structured and scalable financial experience.